Are you tired of paying exorbitant amounts for your health insurance? Look no further! The world of inexpensive health policies is here to save the day. In this article, we will explore the options available to you, without breaking the bank. With rising healthcare costs, finding affordable coverage can be a challenge, but fear not – we’ve got you covered. Whether you’re self-employed, between jobs, or simply looking for a more cost-effective solution, these inexpensive health policies provide the coverage you need without draining your wallet. So, let’s dive in and discover the world of affordable healthcare options!

Factors contributing to the cost of health policies

Premiums

One of the main factors that contribute to the cost of health policies is the amount of premiums you have to pay. Premiums are the regular payments you make to the insurance company to maintain coverage. The cost of premiums can vary greatly depending on factors such as age, location, and health status. Generally, younger and healthier individuals may have lower premiums compared to older individuals or those with pre-existing medical conditions.

Deductibles

Another factor to consider when looking at the cost of health policies is the deductible. A deductible is the amount you have to pay out of your own pocket before the insurance company starts covering your medical expenses. Policies with higher deductibles often have lower premiums, but it means you will have to pay more upfront before your insurance kicks in. Conversely, policies with lower deductibles usually have higher premiums.

Co-pays

Co-pays are a fixed amount of money you have to pay for each visit to the doctor or for specific medical services. Like deductibles, policies with lower co-pays generally have higher premiums. Co-pays can add up quickly if you have multiple doctor visits or require frequent medical services.

Out-of-pocket expenses

Out-of-pocket expenses refer to the costs you are responsible for paying even after your insurance company has covered their portion of the bill. This includes deductibles, co-pays, and any expenses that are not covered by your insurance policy. Understanding your potential out-of-pocket expenses is essential when evaluating the overall cost of a health policy.

Types of inexpensive health policies

Catastrophic health insurance

Catastrophic health insurance is designed to provide coverage for major medical events and emergencies. This type of policy typically has lower premiums but high deductibles. It is ideal for individuals who are generally healthy and don’t need frequent medical care, but still want to be protected from financial devastation in case of a catastrophic event.

Short-term health insurance

Short-term health insurance provides coverage for a limited period, usually up to 364 days. These policies are often less expensive than long-term health insurance plans as they offer temporary coverage to bridge gaps in insurance, such as during job transitions or while waiting for employer-sponsored coverage to begin.

High-deductible health plans (HDHPs)

High-deductible health plans have lower premiums compared to traditional health insurance plans. However, they come with higher deductibles that must be met before the insurance coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to set aside money tax-free to help cover healthcare expenses.

Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts that can be used to cover medical expenses. With an HSA, you can contribute pre-tax dollars to the account, which can then be used to pay for qualified medical expenses. HSAs are often paired with high-deductible health plans and can help individuals save money on healthcare costs while enjoying certain tax benefits.

Benefits and drawbacks of inexpensive health policies

Affordability

Inexpensive health policies offer the benefit of lower premiums, making them more affordable for individuals and families on a tight budget. These policies can help ensure that even with limited financial resources, you have some level of coverage for medical emergencies and major healthcare needs.

Limited coverage

One of the drawbacks of inexpensive health policies is that they often come with limited coverage. These policies may have lower benefit limits, more exclusions, and fewer covered services compared to more comprehensive insurance plans. It’s important to carefully review the coverage details to ensure that the policy meets your specific healthcare needs.

Risk of high out-of-pocket costs

Inexpensive health policies often have higher deductibles and co-pays, which can result in higher out-of-pocket costs for medical care. While the lower premiums may save you money upfront, you need to be prepared to cover a larger portion of your medical expenses out of pocket. This can be a significant consideration if you anticipate needing frequent medical services or have ongoing healthcare needs.

Eligibility criteria for inexpensive health policies

Income requirements

Some inexpensive health policies, such as Medicaid or subsidized marketplace plans, have income requirements that determine eligibility. These programs are designed to provide affordable coverage options to individuals and families with low to moderate incomes. Eligibility criteria for income-based policies vary by state and may consider factors such as household size and income level.

Health status considerations

While many inexpensive health policies do not require a medical exam or detailed health history, your current health status can impact your eligibility and premium rates. Individuals with pre-existing conditions may face challenges when applying for certain types of health insurance or may be subject to higher premiums. It’s important to carefully review the eligibility requirements and health-related considerations before choosing an inexpensive health policy.

Factors to consider when choosing an inexpensive health policy

Coverage limits

When comparing inexpensive health policies, it’s important to review the coverage limits for different medical services and treatments. Some policies may have lower benefit limits or exclude coverage for certain services, which could leave you with significant out-of-pocket costs if you require those services. Understanding the coverage limits will help you determine if the policy provides adequate coverage for your healthcare needs.

Network of providers

Consider the network of providers included in the health policy. Some inexpensive policies may have a more limited network of doctors, hospitals, and specialists. Before choosing a policy, make sure that the healthcare providers you prefer to use and the facilities you rely on for medical care are part of the plan’s network. Otherwise, you may have to pay higher out-of-network costs or switch to different providers.

Prescription drug coverage

If you regularly take prescription medications, it’s important to assess the prescription drug coverage offered by inexpensive health policies. Some policies may have limited or no coverage for certain medications or may require you to pay a higher co-pay or meet a separate deductible for prescription drugs. Make sure to review the formulary, which is a list of covered medications, and check if the policy provides adequate coverage for your specific prescriptions.

Out-of-pocket expenses

While the premium is an essential consideration, it’s equally important to evaluate the potential out-of-pocket costs associated with the policy. Take into account the deductible, co-pays, and any other expenses you may be responsible for under the policy. Balancing the premium with the potential out-of-pocket costs will help you choose an inexpensive health policy that aligns with your budget and healthcare needs.

Comparing different health insurance providers

Premium rates

When comparing different health insurance providers, one of the first things to consider is the premium rates they offer for similar coverage. Premium rates can vary significantly, so it’s worth obtaining quotes from multiple providers to see who can offer you the most competitive rate. Keep in mind that premium rates are not the only factor to consider when evaluating a health insurance provider.

Coverage options

Compare the coverage options offered by different health insurance providers. Pay attention to the benefits, services, and treatments covered by each policy. Look for policies that provide comprehensive coverage for your specific healthcare needs, such as preventive care, maternity care, mental health services, and prescription drugs. The more comprehensive the coverage, the better protected you will be against unexpected medical expenses.

Customer reviews

Take the time to read customer reviews and ratings of different health insurance providers. This can provide valuable insights into the quality of customer service, claims handling, and overall satisfaction with the insurance company. Look for reviews from individuals who have similar healthcare needs or circumstances to get a better understanding of how the provider performs in those areas.

Network of providers

Consider the network of healthcare providers included in each health insurance provider’s plans. Ensure that your preferred doctors, hospitals, and specialists are part of the provider’s network. A broad network of providers will give you more options and lower out-of-pocket costs when seeking medical care. You can usually find network information on the provider’s website or by contacting their customer service.

Government programs for affordable health insurance

Medicaid

Medicaid is a joint federal and state program that provides health insurance coverage to low-income individuals and families. Eligibility for Medicaid varies by state but is generally based on income level, household size, and certain health criteria. Medicaid offers comprehensive coverage at low or no cost to eligible individuals, making it an important resource for those in need of affordable health insurance.

Children’s Health Insurance Program (CHIP)

The Children’s Health Insurance Program (CHIP) provides comprehensive health insurance coverage for children in families with low incomes. CHIP is jointly funded by the federal government and individual states, and eligibility requirements may vary. This program is designed to ensure that children have access to the healthcare they need, even if their parents do not qualify for other assistance programs.

Marketplace subsidies

The health insurance marketplace, also known as the exchange, offers subsidized health insurance plans for individuals and families who do not have access to affordable employer-sponsored coverage. Subsidies, in the form of advanced premium tax credits and cost-sharing reductions, are available to eligible individuals and families to help make insurance more affordable. These subsidies are based on income and household size, and they can significantly reduce the cost of monthly premiums and out-of-pocket expenses.

Tips for saving on health insurance premiums

Shop around and compare quotes

One of the best ways to save on health insurance premiums is by shopping around and comparing quotes from multiple insurance providers. Request quotes from different companies to see who can offer you the most competitive rate for the coverage you need. Keep in mind that price is not the only factor to consider; also consider the coverage and benefits provided by each policy.

Consider higher deductibles

Choosing a health insurance policy with a higher deductible can result in lower premium rates. A deductible is the amount you have to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you assume more financial responsibility upfront, but this can help lower your monthly premiums, making your health insurance more affordable. Just make sure you have enough savings to cover the deductible if needed.

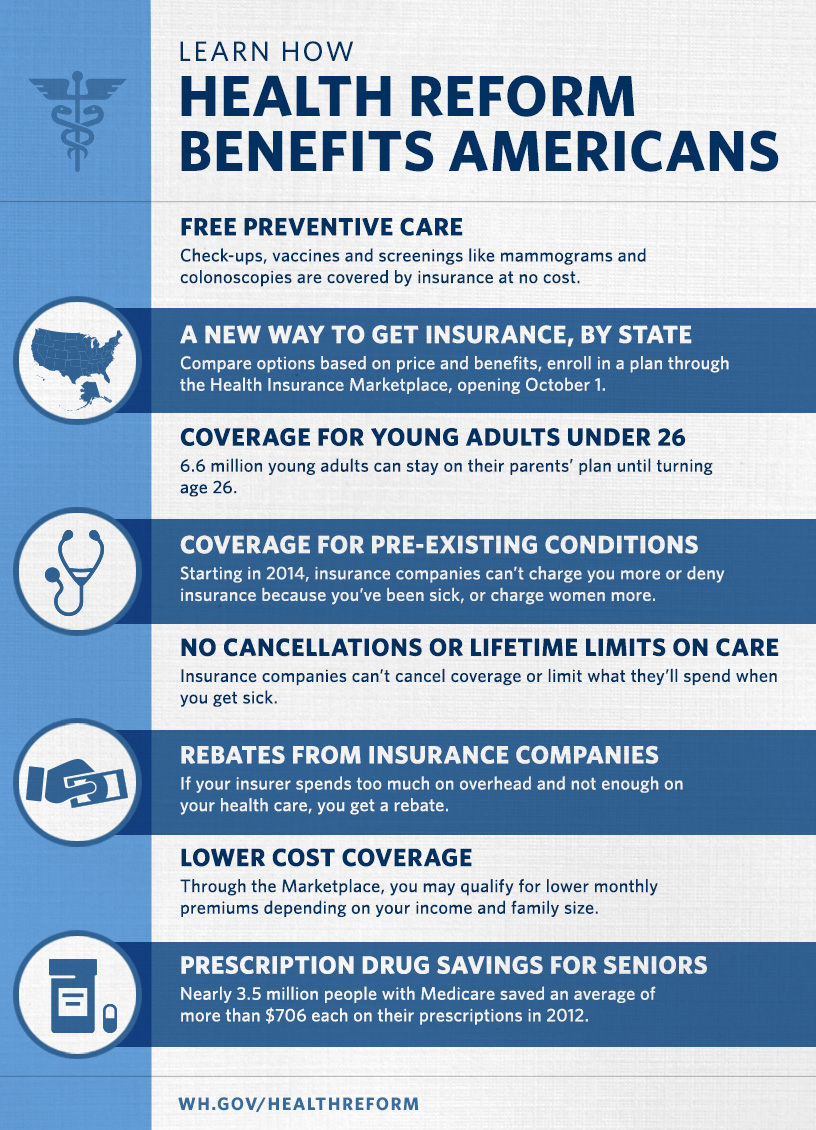

Take advantage of preventive care services

Many health insurance policies offer free or low-cost preventive care services, such as annual wellness check-ups and vaccinations. Taking advantage of these services can help you detect and address potential health issues early, preventing more serious and costly medical conditions in the future. Regular preventive care can also result in better overall health and lower healthcare costs over time.

Maintain a healthy lifestyle

Leading a healthy lifestyle can have a positive impact on your health insurance premiums. Many insurance providers offer wellness programs or discounts for individuals who demonstrate healthy habits, such as regular exercise, non-smoking, and maintaining a healthy weight. By actively taking steps to improve and maintain your health, you can potentially reduce your risk of certain medical conditions and secure lower premiums.

Steps to take if you cannot afford health insurance

Explore public health programs

If you cannot afford health insurance, there are public health programs that can provide coverage based on your income and circumstances. Programs like Medicaid and the Children’s Health Insurance Program (CHIP) can offer comprehensive coverage for low-income individuals and families. Visit your state’s health department website or healthcare marketplace to learn more about these programs and determine your eligibility.

Seek out low-cost clinics

Low-cost clinics, also known as community health centers or non-profit clinics, offer affordable or free healthcare services to individuals who cannot afford traditional insurance or have limited access to healthcare. These clinics provide primary care, preventive services, and sometimes even dental and mental health services. Research local clinics in your area to see if you qualify for their services.

Negotiate medical bills

If you are faced with significant medical bills that you cannot afford to pay, it’s important to communicate with healthcare providers and explore options for negotiating the cost. Many hospitals and doctors are willing to work out payment plans or provide financial assistance for individuals who are unable to pay their bills in full. Reach out to the billing department and explain your situation to see if they can offer any assistance.

Consider healthcare sharing ministries

Healthcare sharing ministries are non-profit organizations that allow members to share medical expenses. Unlike traditional health insurance, these ministries are based on religious or ethical principles and involve members contributing a monthly share amount. When a member incurs medical expenses, the ministry redistributes shares from other members to cover the cost. Healthcare sharing ministries are not health insurance and do not guarantee coverage for all types of medical expenses.

Resources for finding inexpensive health policies

State healthcare marketplaces

State healthcare marketplaces, also known as exchanges, are online platforms where individuals and families can compare and purchase health insurance plans. These marketplaces offer a range of health insurance options, including subsidized plans for those who qualify based on income. Visit your state’s healthcare marketplace website to explore available plans and enroll during the open enrollment period.

Health insurance brokers

Health insurance brokers are licensed professionals who can help you navigate the complexities of the health insurance market. They work with multiple insurance companies and can provide personalized guidance and recommendations based on your specific healthcare needs and budget. Brokers can help you compare different policies and find an inexpensive health insurance plan that meets your requirements.

Non-profit organizations

Non-profit organizations, such as consumer advocacy groups and healthcare foundations, may offer resources and guidance on finding inexpensive health insurance options. These organizations typically focus on improving access to healthcare and can provide information on affordable insurance plans and potential financial assistance programs. Check with non-profit organizations in your area or visit their websites for valuable resources.

Employer-sponsored options

If you are employed, your employer may offer health insurance options as part of an employee benefits package. Employer-sponsored health insurance plans often provide a more affordable option compared to individual plans as the cost is typically shared between the employer and employee. Speak with your employer’s human resources department to understand the health insurance options available to you through your job.