Looking for an affordable solution for your health insurance needs? Look no further than Discounted Health Insurance! Designed with individuals like you in mind, we offer a wide range of comprehensive coverage options at discounted rates. With our user-friendly platform and personalized customer support, you can easily find the perfect plan to suit your budget and healthcare requirements. Say goodbye to sky-high premiums and hello to peace of mind knowing that your health is protected without breaking the bank. Discover the benefits of Discounted Health Insurance today!

Types of Discounted Health Insurance

Group Health Insurance

Group health insurance refers to health insurance coverage provided by an employer or an organization to a group of individuals. It is an excellent way to obtain discounted health insurance as the risk is spread across a larger pool of individuals, which often results in lower premium costs. Group health insurance typically offers comprehensive coverage and a wide range of benefits, including preventive care, hospitalization, and prescription drug coverage.

Individual Health Insurance

Individual health insurance is a type of health insurance that is purchased by an individual directly from an insurance company. While it may not offer the same discounted rates as group health insurance, individual health insurance can still be an affordable option for those who do not have access to employer-sponsored coverage. It allows individuals to customize their coverage according to their specific needs and often includes benefits such as doctor visits, hospitalization, and prescription drug coverage.

Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) are government programs that provide discounted health insurance to low-income individuals and families. Medicaid is a joint federal and state program that offers comprehensive coverage at little to no cost for eligible individuals. CHIP, on the other hand, is specifically designed to provide health insurance coverage for children in families who earn too much to qualify for Medicaid but still need assistance.

COBRA Coverage

COBRA, which stands for the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows individuals to continue their health insurance coverage temporarily after they have left their jobs, lost their job, or experienced other qualifying events. While COBRA coverage may not offer discounted rates like other types of health insurance, it does provide a valuable option for those who need continued access to their employer-sponsored health insurance.

Ways to Obtain Discounted Health Insurance

Employer-Sponsored Health Insurance

One of the most common ways to obtain discounted health insurance is through employer-sponsored coverage. Many employers offer health insurance benefits as part of their employee compensation package, providing their employees with access to discounted rates and comprehensive coverage. This type of health insurance is typically convenient and affordable, as the employer often shares the cost of the premiums with the employee.

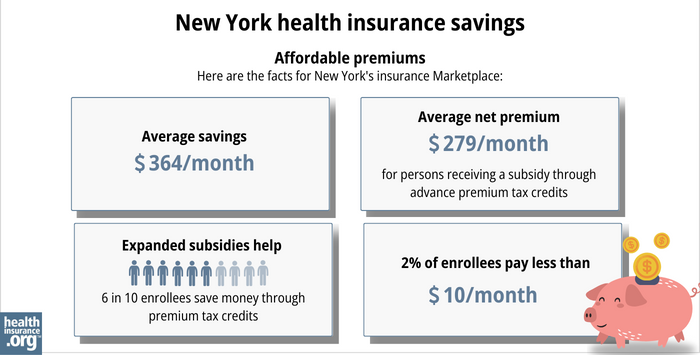

Health Insurance Marketplaces

Health insurance marketplaces, also known as exchanges, are online platforms where individuals can compare and purchase health insurance plans. These marketplaces were established as part of the Affordable Care Act and provide a way for individuals to access affordable health insurance options. Through these marketplaces, individuals can compare different plans, review coverage options, and determine if they qualify for any financial assistance, such as tax credits or subsidies.

Medicaid or CHIP

As mentioned earlier, Medicaid and CHIP are government programs that offer discounted health insurance to low-income individuals and families. Eligibility for these programs is based on income and other criteria, and they provide comprehensive coverage at little to no cost. Individuals can apply for Medicaid or CHIP through their state’s Medicaid or CHIP program, and if approved, they can access affordable health insurance coverage.

COBRA Coverage

For individuals who have recently left a job or experienced other qualifying events, COBRA coverage can provide a way to maintain their employer-sponsored health insurance, albeit at a higher cost. While COBRA coverage is not typically discounted, it offers a valuable option for those who need continued access to their previous health insurance plan. Individuals can typically continue their coverage for a set period, allowing them to bridge the gap until they find an alternative health insurance solution.

Government Programs

In addition to Medicaid and CHIP, there are other government programs that offer discounted health insurance to specific populations. For example, the Veterans Health Administration provides health insurance benefits to eligible veterans, while the Indian Health Service offers health care services to eligible Native Americans and Alaska Natives. These programs aim to ensure that specific populations have access to affordable and comprehensive health insurance coverage.

Qualifications for Discounted Health Insurance

Income Eligibility

Income eligibility is one of the primary qualifications for discounted health insurance programs such as Medicaid, CHIP, and financial assistance through the health insurance marketplaces. These programs have specific income thresholds that individuals and families must meet in order to qualify for discounted rates or subsidies. The income eligibility criteria vary depending on the program and the state, but they are designed to ensure that those with lower incomes have access to affordable health insurance options.

Employment Status

Employment status may also impact eligibility for certain types of discounted health insurance. For example, employer-sponsored health insurance is typically only available to individuals who are employed by an organization that offers such benefits. Similarly, COBRA coverage is only offered to individuals who were previously enrolled in an employer-sponsored health insurance plan and experienced a qualifying event that allows them to continue their coverage.

Age and Family Size

Age and family size can play a role in determining eligibility for discounted health insurance programs. Some programs, such as Medicaid and CHIP, have specific eligibility criteria based on the age of the individual or the number of individuals in the household. For example, Medicaid may provide coverage for children up to a certain age or for pregnant women, while CHIP may offer coverage for children in families with incomes that exceed Medicaid limits.

Residential Requirements

Certain discounted health insurance programs may have residency requirements that individuals must meet to be eligible for coverage. These requirements typically involve being a resident of a specific state or country for a certain period of time. Residency requirements are put in place to ensure that the benefits of the program are provided to individuals who genuinely reside in the designated area, allowing for more efficient allocation of resources.

Pre-Existing Conditions

Pre-existing conditions, which are health conditions that individuals have prior to obtaining health insurance coverage, can affect eligibility for discounted health insurance. However, under the Affordable Care Act, health insurance companies are prohibited from denying coverage or charging higher premiums based on pre-existing conditions. This means that individuals with pre-existing conditions cannot be disqualified from obtaining discounted health insurance, allowing them to access affordable and comprehensive coverage.

Benefits and Limitations of Discounted Health Insurance

Affordability

One of the primary benefits of discounted health insurance is affordability. Discounted health insurance programs offer lower premium rates or financial assistance to individuals and families with lower incomes, making health insurance more accessible and affordable. This allows individuals to protect themselves and their families from high medical costs without breaking the bank.

Access to Quality Care

Another significant benefit of discounted health insurance is the ability to access quality healthcare. These programs often provide comprehensive coverage that includes services such as preventive care, hospitalization, and emergency care. By having access to affordable health insurance, individuals can seek timely and necessary healthcare services, improving their overall health and well-being.

Prescription Drug Coverage

Many discounted health insurance programs also include prescription drug coverage as part of their benefits. This is crucial for individuals who rely on medications to manage chronic conditions or who need medications for acute illnesses. Having access to affordable prescription drug coverage ensures that individuals can obtain the necessary medications at a lower cost, promoting medication adherence and overall health.

Specialized Services

Discounted health insurance programs also often cover specialized services, such as mental health services, maternity care, and substance abuse treatment. These services may otherwise be unaffordable for individuals without insurance or with limited coverage. By providing access to these specialized services, discounted health insurance programs address a range of healthcare needs and ensure that individuals can receive comprehensive and appropriate care.

Network Restrictions

One limitation of discounted health insurance may be network restrictions. Some health insurance plans, particularly those offered through Medicaid or CHIP, may have limited networks of healthcare providers. While this can limit the choice of providers and require individuals to seek care from specific network providers, it is a trade-off for affordable coverage. However, many networks are still comprehensive and provide access to a wide range of healthcare professionals and facilities.

Comparison of Discounted Health Insurance Providers

Premium Costs

When comparing discounted health insurance providers, one essential factor to consider is the premium costs. Different programs and insurance plans have varying premium amounts that individuals and families must pay to maintain their coverage. Comparing premium costs can help individuals determine which option best fits their budget and financial situation.

Coverage Options

Coverage options also vary among discounted health insurance providers. While some programs may offer comprehensive coverage that includes a wide range of healthcare services, others may have more limited coverage. Understanding the coverage options and determining which services are essential for individual or family needs is crucial when comparing different providers.

Network Providers

The network of healthcare providers is another important consideration. Different health insurance programs and plans may have different networks, meaning individuals may have limited options when it comes to choosing healthcare providers. Reviewing the network providers can help individuals determine if their preferred doctors, hospitals, or specialists are included in the network.

Additional Benefits

Along with the basic coverage, discounted health insurance providers may offer additional benefits that add value to their plans. These benefits can include services such as dental and vision care, wellness programs, and alternative therapies. Considering these additional benefits can help individuals choose a plan that aligns with their specific needs and preferences.

Customer Satisfaction

Customer satisfaction is a crucial element to consider when comparing discounted health insurance providers. Reading reviews and ratings from current or former customers can provide insights into the level of customer service, the ease of use, and the overall satisfaction with the coverage. Choosing a provider with a high level of customer satisfaction can help ensure a positive experience with the health insurance plan.

Tips for Maximizing Discounted Health Insurance

Understand Coverage Options

To maximize the benefits of discounted health insurance, it is essential to thoroughly understand the coverage options available. Read through the plan documents and familiarize yourself with the covered services, limitations, and any requirements, such as pre-authorization for certain procedures. By understanding the coverage, you can effectively navigate the healthcare system and make informed decisions about your care.

Review Network Providers

Take the time to review the network providers available through your discounted health insurance plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network. If you have specific healthcare needs or ongoing conditions, it is crucial to have access to providers who can meet those needs effectively. If necessary, consider switching plans to one that offers the desired network providers.

Utilize Preventive Care

Discounted health insurance often includes coverage for preventive care services at little to no cost. Take advantage of these services as they can help detect potential health issues early on and prevent more serious conditions from developing. Schedule regular check-ups, screenings, and vaccinations as recommended by healthcare professionals. By staying proactive in your healthcare, you can maintain your overall well-being and catch any potential problems at an early stage.

Compare Premium Costs

While affordability is a significant advantage of discounted health insurance, it is still important to compare premium costs among different providers. Different plans may have varying premium amounts that can impact your budget. Consider your financial situation and select a plan with a premium that you can comfortably afford while still meeting your healthcare needs.

Seek Financial Assistance

If you find that even discounted health insurance is challenging to afford, explore options for financial assistance. Many programs, including Medicaid, offer financial assistance to eligible individuals and families to further reduce the cost of health insurance. Additionally, some organizations and foundations may provide grants or subsidies for specific healthcare needs. Do thorough research and reach out to relevant resources to explore all potential avenues for financial assistance.

Common Misconceptions About Discounted Health Insurance

Lower Quality of Care

One common misconception about discounted health insurance is that it provides lower-quality care compared to more expensive plans. However, this is often not the case. Discounted health insurance programs, such as Medicaid, must meet specific standards set by the government to ensure the quality of care provided. Additionally, many discounted health insurance plans include coverage for preventive care and essential healthcare services, ensuring access to comprehensive and quality care.

Limited Coverage Options

Discounted health insurance programs are often wrongly assumed to have limited coverage options. While certain programs may have specific limitations, such as network restrictions, the coverage provided is still comprehensive and designed to address a broad range of healthcare needs. It is crucial to review and understand the coverage options available under discounted health insurance programs rather than assuming limitations without proper research.

Difficulty Finding Providers

Another misconception is that it is challenging to find healthcare providers who accept discounted health insurance plans. While it is true that some health insurance plans have limited networks, most programs include a range of healthcare providers. It is essential to review the network providers and confirm the availability of preferred healthcare professionals before selecting a plan. With proper research, individuals can find suitable providers who accept their discounted health insurance.

Lack of Prescription Drug Coverage

Some individuals mistakenly believe that discounted health insurance programs do not include prescription drug coverage. However, many programs, including Medicaid and CHIP, offer comprehensive coverage for prescription medications. It is essential to review the details of the health insurance plan to ascertain the extent of prescription drug coverage and any potential limitations or requirements.

Ineligibility for Pre-Existing Conditions

In the past, pre-existing conditions often made individuals ineligible for health insurance coverage or led to higher premiums. However, under the Affordable Care Act, health insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. This applies to discounted health insurance programs as well. Individuals with pre-existing conditions can access affordable health insurance coverage and receive necessary care without facing discrimination or additional financial burdens.

Future Trends in Discounted Health Insurance

Telehealth Services

One future trend in discounted health insurance is the increasing utilization of telehealth services. Telehealth allows individuals to consult with healthcare providers remotely, using technology such as video calls or telephone consultations. This provides convenient and cost-effective access to healthcare services, especially for individuals in remote areas or with limited mobility. Discounted health insurance programs may incorporate telehealth services to improve access to care and reduce healthcare costs.

Value-Based Care

Value-based care is a healthcare delivery model that focuses on improving patient outcomes while reducing costs. It incentivizes healthcare providers to deliver high-quality and efficient care, promoting better health outcomes for patients. Discounted health insurance programs may integrate value-based care models to ensure that the care provided is effective and aligned with patient needs, resulting in improved health outcomes and reduced healthcare expenses.

Health Savings Accounts

Health savings accounts (HSAs) are accounts that individuals can use to save money for medical expenses. Contributions to HSAs are tax-deductible, and the funds can be used to pay for qualified medical expenses tax-free. Discounted health insurance programs may encourage individuals to establish HSAs as a way to save on healthcare costs and reduce their overall expenses. This can be particularly beneficial for those with high-deductible health plans, as HSAs help offset the higher out-of-pocket costs.

Alternative Health Insurance Models

Innovative and alternative health insurance models may also emerge in the future. These models can introduce new ways of structuring and delivering healthcare coverage to expand access and affordability. Examples include health cooperatives, where individuals pool their resources to obtain affordable coverage, and direct primary care, where individuals pay a fixed monthly fee for primary care services. Discounted health insurance programs may explore these alternative models to provide more options and flexibility to individuals seeking affordable coverage.

Technology Integration

Technology integration within discounted health insurance programs is likely to increase in the coming years. This can include digital tools and platforms that simplify the enrollment process, allow individuals to access their health insurance information digitally, or provide health management resources. By leveraging technology, discounted health insurance programs can enhance efficiency, improve communication, and empower individuals to take control of their healthcare.

Impact of Discounted Health Insurance on Individuals and Society

Improved Access to Healthcare

One of the most significant impacts of discounted health insurance is improved access to healthcare. Affordable coverage ensures that individuals and families can seek necessary medical care without financial barriers. This promotes early detection and prevention of health conditions, leading to better health outcomes and improved overall well-being.

Financial Relief for Individuals

Discounted health insurance provides financial relief for individuals who would otherwise struggle to afford healthcare costs. It reduces the financial burden of medical expenses, including doctor visits, hospital stays, and prescription medications. Affordable health insurance allows individuals to allocate their resources to other essential needs, such as housing, education, and food security.

Preventive Care and Early Detection

Discounted health insurance often covers preventive care services, such as vaccinations, screenings, and wellness check-ups, at little to no cost. This emphasis on preventive care helps identify potential health issues early on, when they are easier to treat and manage. By promoting preventive care and early detection, discounted health insurance programs contribute to better health outcomes and reduce the overall burden on the healthcare system.

Reduced Burden on Healthcare System

When individuals have access to affordable health insurance, they are more likely to seek timely medical care. This reduces the strain on emergency rooms and prevents the overutilization of healthcare resources. By reducing the burden on the healthcare system, discounted health insurance programs contribute to more efficient and effective healthcare delivery for all individuals, regardless of their insurance status.

Economic Benefits

Discounted health insurance programs have economic benefits for both individuals and society as a whole. By reducing the financial burden of healthcare costs, individuals have more financial stability, allowing them to contribute to the economy through spending, saving, and investing. Additionally, by promoting better health outcomes and preventive care, discounted health insurance programs reduce productivity losses due to illness and absenteeism, resulting in a more productive workforce.

Conclusion

Discounted health insurance plays a crucial role in making healthcare more accessible and affordable to individuals and families. By offering a range of discounted health insurance options, including group health insurance, individual health insurance, Medicaid and CHIP, and COBRA coverage, individuals can choose the best fit for their needs and financial circumstances. Through employer-sponsored coverage, health insurance marketplaces, and government programs, individuals can obtain discounted health insurance that helps them access quality care, including prescription drug coverage and specialized services. Understanding qualifications, benefits, and limitations is important when considering discounted health insurance. By comparing providers based on premium costs, coverage options, network providers, additional benefits, and customer satisfaction, individuals can make informed decisions about their healthcare coverage. Maximizing discounted health insurance through understanding coverage options, reviewing network providers, utilizing preventive care, comparing premium costs, and seeking financial assistance can help individuals make the most of their coverage. Addressing common misconceptions about discounted health insurance, such as lower quality of care or limited coverage options, promotes a better understanding of the benefits these programs offer. Future trends, such as telehealth services, value-based care, health savings accounts, alternative health insurance models, and technology integration, are likely to further enhance discounted health insurance offerings. The impact of discounted health insurance on individuals and society is significant, as it improves access to healthcare, provides financial relief, promotes preventive care and early detection, reduces the burden on the healthcare system, and contributes to economic benefits. Overall, discounted health insurance is a valuable tool in ensuring that individuals have affordable and comprehensive coverage to meet their healthcare needs.