Imagine a world where maintaining good health was not only essential for your well-being but also rewarded with discounts on your health insurance. Well, this is no longer just a fantasy. The article “Health Insurance Discounts” explores the exciting new trend of health insurance companies offering discounts to policyholders who actively prioritize their health. Discover how these incentives are revolutionizing the way we view and approach our healthcare, and how they can potentially benefit you by making health insurance more accessible and affordable.

Understanding Health Insurance Discounts

What are Health Insurance Discounts?

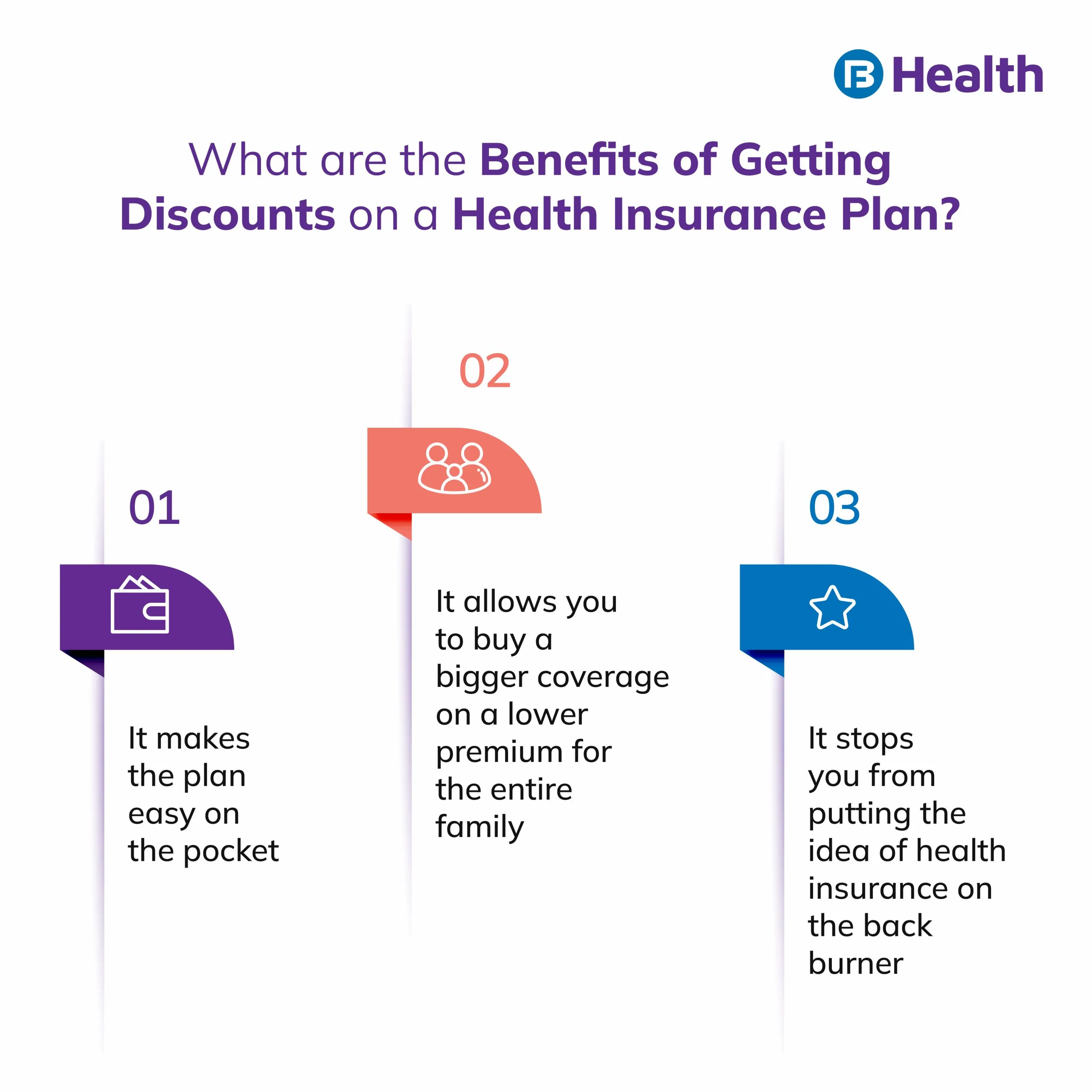

Health insurance discounts are financial incentives provided by insurance providers to reduce the cost of health insurance premiums, deductibles, copayments, and other out-of-pocket expenses. These discounts are offered to policyholders as a way to make healthcare more affordable and accessible. By taking advantage of these discounts, you can save money on your health insurance costs and still receive quality medical care.

Types of Health Insurance Discounts

There are various types of health insurance discounts that you can take advantage of:

-

Age-Based Discounts: Some insurance providers offer discounts based on your age. Younger individuals, such as students or recent graduates, may be eligible for special rates or discounted premiums.

-

Employer-Based Discounts: Many employers provide health insurance benefits to their employees, often at a discounted group rate. This can significantly reduce the cost of insurance for individuals and their families.

-

Insurance Company-Based Discounts: Insurance companies may offer discounts to policyholders who have multiple policies with them, such as auto and home insurance. Bundling your insurance can help you save on premiums.

-

Membership-Based Discounts: Some organizations, memberships, or professional groups offer health insurance discounts to their members. This can include alumni associations, trade unions, or professional associations.

-

Healthy Lifestyle Discounts: Insurance companies may incentivize healthy behaviors by offering discounts to individuals who demonstrate healthy habits. This can include maintaining a certain body mass index (BMI), participating in regular exercise, or not smoking.

Qualifying for Health Insurance Discounts

Age-Based Discounts

Age-based discounts are typically available to younger individuals, such as students or recent graduates. Insurance providers may offer lower premiums or special rates for individuals within a specific age range. These discounts recognize that younger individuals generally have fewer health concerns and require less healthcare services.

Employer-Based Discounts

Many employers offer health insurance benefits to their employees as part of their overall compensation package. These employer-sponsored plans often come at a discounted group rate, making the premiums more affordable for employees. To qualify for employer-based discounts, you usually need to be a current employee of the organization.

Insurance Company-Based Discounts

Some insurance companies encourage policyholders to consolidate their insurance policies with them. For example, if you have multiple policies with the same insurance provider, such as auto, home, and health insurance, you may be eligible for a multi-policy discount. Combining your policies can lead to lower premiums and overall cost savings.

Membership-Based Discounts

Certain organizations and memberships offer health insurance discounts to their members. This can include alumni associations, trade unions, professional associations, or other groups. By joining these organizations or associations, you may gain access to exclusive insurance discounts. It is worth checking if any memberships you have offer health insurance discounts.

Healthy Lifestyle Discounts

Leading a healthy lifestyle can also lead to health insurance discounts. Insurance companies may reward individuals who demonstrate healthy behaviors by offering lower premiums or other cost-saving incentives. This can include maintaining a healthy weight, participating in regular exercise, not smoking, or managing chronic conditions effectively.

How to Find Health Insurance Discounts

Researching Different Insurance Providers

Finding health insurance discounts starts with researching different insurance providers. Look for reputable insurance companies that offer comprehensive coverage and competitive rates. Read reviews, compare customer satisfaction ratings, and assess the provider’s reputation for delivering quality customer service. Additionally, check if the insurance companies you are considering offer any discounts or incentives that align with your needs.

Comparing Plans and Discounts

Once you have identified a few insurance providers that you are interested in, compare their plans and associated discounts. Assess the coverage options, including deductibles, copayments, and out-of-pocket maximums, to determine which plan provides the best value for your needs. Additionally, review the available discounts and evaluate how they can further reduce your healthcare costs.

Utilizing Government Resources

The government provides resources to help individuals find health insurance discounts. Visit the official website of the Department of Health and Human Services or use the Health Insurance Marketplace to explore different insurance options and potential discounts. These resources can guide you through the process of finding affordable insurance coverage and identify any available subsidies or tax credits.

Seeking Professional Advice

If navigating the world of health insurance discounts seems overwhelming, consider seeking professional advice. Insurance brokers or agents can help you understand the intricacies of insurance policies and guide you towards the best discounts and coverage options for your specific needs. They have expertise in the industry and can provide valuable insights that can save you time and money.

Tips on Maximizing Health Insurance Discounts

Maintaining Good Health

Maintaining good health is not only beneficial for your overall well-being but can also lead to health insurance discounts. By staying active, eating a balanced diet, managing stress, and taking preventive measures, such as getting regular check-ups, you can potentially reduce your healthcare costs. Insurance companies often offer discounts to policyholders who demonstrate healthy behaviors and have fewer medical claims.

Preventive Care and Immunizations

Taking advantage of preventive care and immunizations can also maximize your health insurance discounts. Many insurance plans cover preventive services, such as annual check-ups, vaccinations, and screenings, at no additional cost or with low copayments. These services can help detect potential health issues early on and prevent more costly treatments down the line.

Utilizing Preferred Providers

Insurance providers often have a network of preferred providers, which are healthcare professionals and facilities that have agreed to provide services at discounted rates to policyholders. By utilizing these preferred providers, you can take advantage of negotiated rates and potentially lower out-of-pocket costs. Before seeking medical care, check if your insurance plan has a preferred provider network and choose healthcare providers within that network whenever possible.

Understanding Policy Terms and Conditions

To maximize your health insurance discounts, it is crucial to understand your policy’s terms and conditions. Familiarize yourself with the coverage limits, copayments, deductibles, and any other factors that may impact your out-of-pocket expenses. By understanding your policy, you can make informed decisions about your healthcare and take full advantage of the discounts available to you.

Regularly Reviewing and Updating Coverage

In order to ensure you are getting the most out of your health insurance discounts, regularly review and update your coverage. Life circumstances and healthcare needs may change over time, so it is important to reassess your insurance options periodically. By staying proactive and adjusting your coverage as needed, you can continue to benefit from the most cost-effective health insurance discounts available.

Common Misconceptions about Health Insurance Discounts

Discounts Mean Limited Coverage

One common misconception about health insurance discounts is that they come with limited coverage. However, this is not necessarily true. Discounts are offered to make health insurance more affordable, but they do not necessarily mean sacrificing coverage. It is possible to find comprehensive insurance plans with substantial discounts that still provide a wide range of medical services and benefits.

Discounts Aren’t Worth the Effort

Another misconception is that the effort required to find and apply for health insurance discounts is not worth the potential savings. While it may take some time and research to identify the right discounts for your needs, the cost savings can be significant. By taking the initiative to find and utilize health insurance discounts, you can potentially save hundreds or even thousands of dollars on your healthcare expenses.

Discounts are Only for the Unhealthy

Contrary to popular belief, health insurance discounts are not exclusively reserved for the unhealthy. In fact, many discounts incentivize healthy behaviors and reward individuals who maintain a healthy lifestyle. By demonstrating healthy habits, you can qualify for discounts and potentially enjoy lower premiums and out-of-pocket costs.

Discounts are Available for Everyone

While health insurance discounts are available to many, it is important to note that they may not be accessible to everyone. The availability of discounts depends on various factors, including your age, employment status, and membership affiliations. Additionally, not all insurance providers offer the same discounts. It is essential to thoroughly research your options and understand the eligibility criteria for each discount before assuming they are universally available.

Conclusion

Health insurance discounts play a significant role in making healthcare more affordable and accessible. By understanding the different types of discounts available, qualifying for them, researching insurance providers, and maximizing your discounts, you can save money on your health insurance costs while still receiving quality medical care. Remember to stay proactive, maintain good health, utilize preventive care services, and regularly review and update your coverage to ensure you are getting the most out of your health insurance discounts.